Group Insurance vs Individual Life Insurance

“I already have life insurance from work, so why do I need to get it personally?” or “Work has got me covered, I don’t need it.”

While it’s great to have group coverage from your employer or association, in most cases, people don’t understand that there are important differences when it comes to group life insurance vs. self owned life insurance.

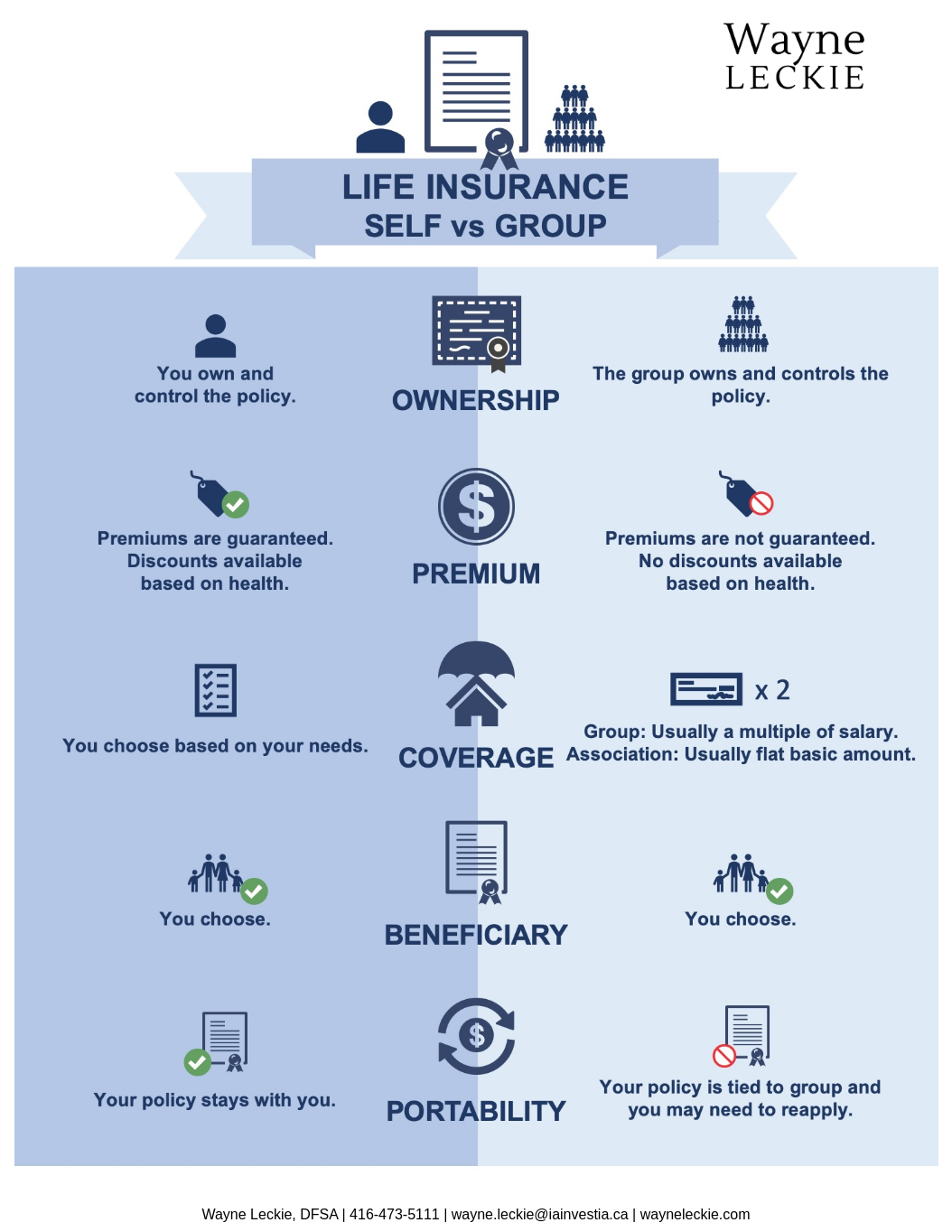

Before counting on insurance from your group benefits plan, please take the time to understand the difference between group owned life insurance and personally owned life insurance. The key differences are ownership, premium, coverage, beneficiary and portability.

Ownership:

- Self: You own and control the policy.

- Group: The group owns and controls the policy.

Premium:

- Self: Your premiums are guaranteed at policy issue and discounts are available based on your health.

- Group: Premiums are not guaranteed and there are no discounts available based on your health. The rates provided are blended depending on your group.

Coverage:

- Self: You choose based on your needs.

- Group: In a group plan, the coverage is typically a multiple of your salary. If your coverage is through an association, then it’s usually a flat basic amount.

Beneficiary:

- Self: You choose who your beneficiary is and they can choose how they want to use the insurance benefit.

- Group: You choose who your beneficiary is and they can choose how they want to use the insurance benefit.

Portability:

- Self: Your policy stays with you.

- Group: Your policy is tied to your group and if you leave your employer or your association, you may need to reapply for insurance.

Talk to us, we can help you figure out what’s best for your situation.